What is Childminding?

A Childminder single-handily cares for a small group of children in the childminder’s own home.

A childminding service involves an individual taking care, by his or herself, of children under the age of 15 years, for payment, in the childminder’s home. A childminder is self-employed and provides a paid childcare service for a minimum of 2 hours a day in their own home.

Childminders offer a flexible service, tailored to each child, thereby helping parents and guardians to balance their work and family commitments. A childminder negotiates and agrees their terms with parents. Childminders have sole responsibility for the health, safety and wellbeing of each child entrusted to their care.

Wicklow County Childcare Committee offers a dedicated information and support service to childminders and those interested in setting up a childminding business in Co Wicklow.

A variety of consultations, such as phone, email, online or face to face meetings are available to childminders or potential childminders to support you in with your business needs. We provide information on the following:

- General start-up information

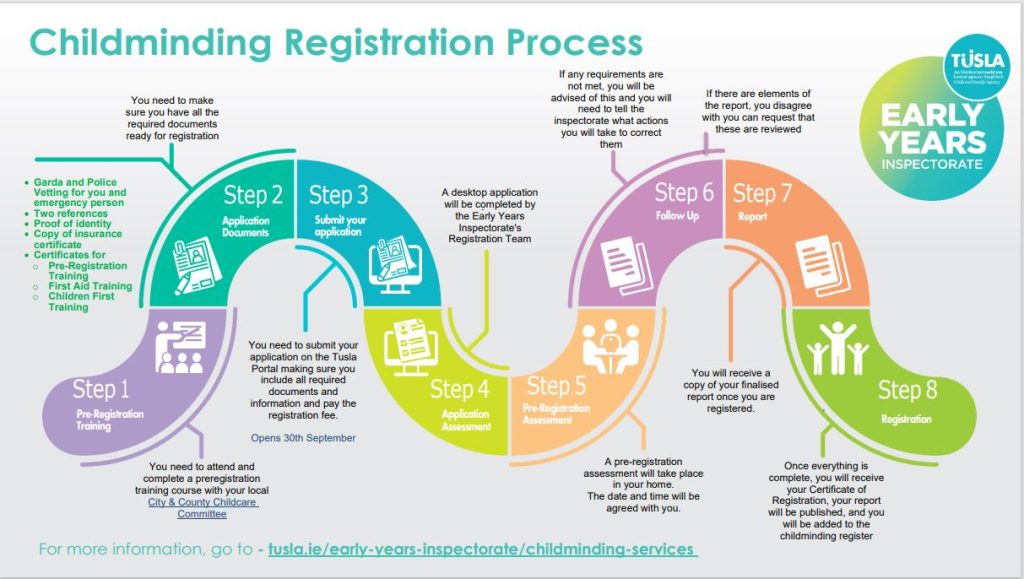

- Overview of the Tusla registration process

- Childminding Pre-Registration Training

- Information on funding schemes

- Training opportunities for childminders

- The Childminding Development Grant

If you are considering becoming a childminder in your own home, please contact Wicklow County Childcare Committee on (0404) 64455 and speak to our Childminding Development Officer.

Legislation

New Childminding Specific Regulations have been launched by the Department of Children, Equality, Disability, Integration and Youth (DECDIY). To access these regulations and the guidance document please follow the links below.

The Child Care Act 1991 (Early Years Services) (Childminding Services) Regulations 2024

Relevant sections of the Child Care (Amendment) Act 2024 will be commenced on the same day and, in line with the Act, there will be a transition period of three years following the commencement of the Regulations. During this 3-year transition period, childminders will be able to register with Tusla, but they will not be required to do so.

Once registered by Tusla, childminders can then also apply to take part in the National Childcare Scheme.

Childminding Development Grant

The CMDG is open to all childminders and covers a wide range of items and equipment that can greatly benefit your childminding services. These include toys, childcare equipment, safety equipment, outdoor toys and play equipment, toys and equipment to support inclusion and equipment for activities to support STEAM (Science, Technology, Engineering, Arts & Maths) opportunities in your childminding setting.

Contact us at info@wccc.ie or 0404 64455 for more information.

Grant applications are now closed for 2024

Childminder Pre-Registration Training

All childminders must complete the Childminding Pre-Registration Training. This is a new mandatory course for anyone who intends to register a childminding service with Tusla.

To take this training course you must be:

- 18 years old or over

- Self-employed and providing a paid childcare service in your own home

- Currently working as a childminder and intending to register with Tusla, OR intending to work as a childminder and register with Tusla

The aim of the Pre-Registration Training programme is to help you:

- Understand the new childminding regulations

- Apply the regulations to your childminding practice

- Understand the Tusla registration process for childminders

- Understand the documentation required to register with Tusla

- Access supports and resources

This training is organised and deliver by Wicklow County Childcare Committee. If you are interested in attending this training or would like more information please contact us and speak to our dedicated Childminding Development Officer for information and support.

Childcare Services Relief (Childminder’s tax exemption)

The Childcare Services Relief is available to childminders who care for 3 children or less in their own home at any one time and ear less than €15,000.

The purpose of the relief is to provide an exemption from income tax, where certain conditions are met, to individuals who provide childminding services in their own homes. To avail of this, childminders should register with Revenue on-line services (ROS).

The main legal obligation when becoming self-employed is that childminders must register as a self-employed person with Revenue. Childminders pay tax on the profits from their business and on any other income that they have. See Registering for Tax for guidance on registering as a self-employed person.

Additional information and Resources for Childminders

- Early Years Inspectorate – Childminding ServicesTusla – Child and Family Agency

- Guide To The Tusla Portal

- Guide To Tusla Registration Application Process

- Guide to Pre-Registration Assessments for Childminders

- Childminder Guidance on Safe Sleep

- Barnardos – Childminder Specific Publications

- Info for Childminders (childsafeguardingelc.ie)